Stock Prices

March 20, 2025 · 1 min read · Page View:

If you have any questions, feel free to comment below. Click the block can copy the code.

And if you think it's helpful to you, just click on the ads which can support this site. Thanks!

This is a tutorial for stock prices in the context of random processes.

SOME FUNDAMENTALS ON STOCKS AND INVESTMENTS #

- Return = [CashFlow+(Price1 - Price0)/Price0]

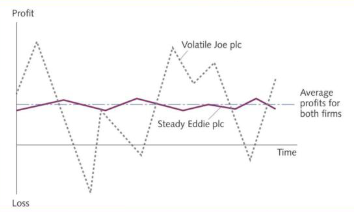

- Risk: Most investors are risk averse, thus prefer “Steady Eddie” to “Volatile Joe”. Investors demand higher return for stocks with volatile business performance.

FACTORS IMPACTING STOCK PRICES #

- Market: Liquidity, Supply/demand, Addition to/Removal from Stock Index, Investment ratings, Sentiment, Market Profitability.

- Corporate Activities: Profitability, Business prospects / growth, Improved Profitability (Sales/Costs), Competition (Business / Capital Market), Corporate Governance, Red Flag, Stability and predictability.

- MACRO FACTORS: General Economy/Business Environment, Government(Political/Legal/Economics), Overall Political Environment, Social Changes, Costs of Input, Business Prospects.

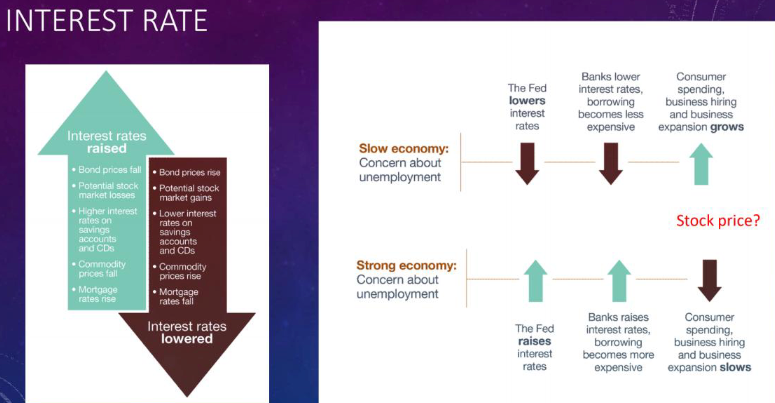

- INTEREST RATE

RANDOM WALK MODEL #

- In a random walk model, the series itself is not random, but its differences (the changes from one period to the next) are random.

- Mathematically, $X_{t}=X_{t - 1}+e_{t}$ or $X_{t}-X_{t - 1}=e_{t}$, where $x_{t}$ is the value in time period $t$, $x_{t - 1}$ is the value in time period $t - 1$, and $e_{t}$ is the value of the error term in time period $t$.

- Transforming a series (e.g., changing to first differences) can help forecast future trends. If a series follows a random walk, the original series may offer little insight, and analyzing the first-differenced series may be necessary.

INTEL CLOSING PRICES #

$H_{0}$: The series is random.

$H_{1}$: The series is not random.

Original series:

- Number of runs up and down = 76. Expected number of runs = 104.333. p-value = 1.16648E - 7. Since the p-value < 0.05, we can reject $H_{0}$. The original series for Intel Closing Prices is not random.

First-differenced series:

- Number of runs up and down = 99. Expected number of runs = 104.333. p-value = 0.357469. Since the p-value > 0.05, we cannot reject $H_{0}$. The first-differenced series for Intel Closing Prices is random.

Conclusion for Intel Closing Prices [6/16/97 - 6/12/00]: The series (Intel Closing Prices) is not random, but its differences are random. It follows a random walk model.

Related readings

If you want to follow my updates, or have a coffee chat with me, feel free to connect with me: